Master Trading on NYYU

Complete guide to trading cryptocurrencies with market and limit orders, risk management, and technical analysis

Trading Tutorial

Master Trading on NYYU

Learn to execute trades like a pro with market and limit orders, understand the order book, manage risk effectively, and use advanced trading tools to maximize your profits.

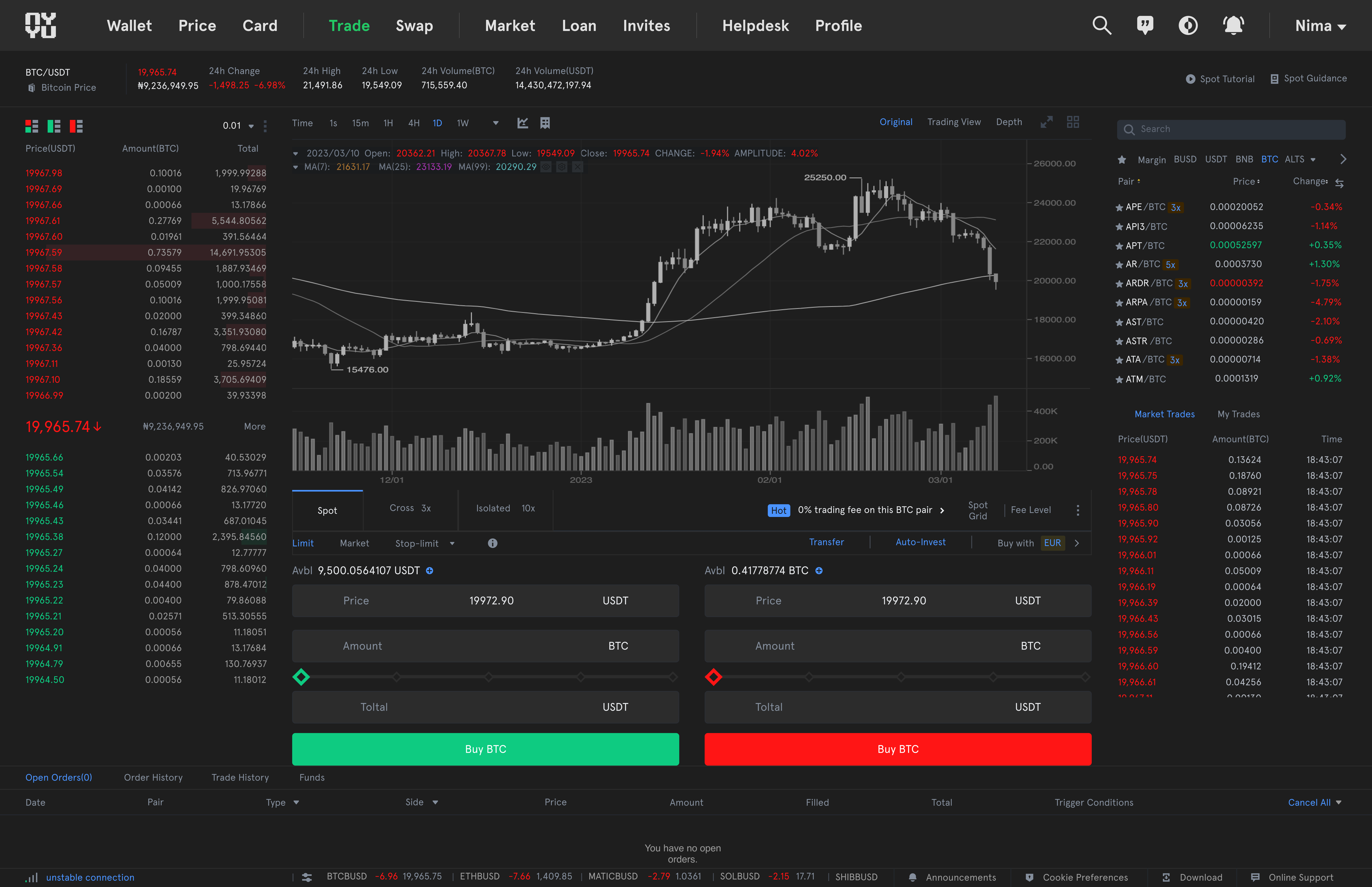

NYYU Trade Overview

The NYYU Trade section provides comprehensive trading capabilities with real-time data, advanced charting tools, and an intuitive interface for executing trades efficiently.

What You'll Learn

Master limit, market, and stop-limit orders for different strategies

Read market depth and identify support/resistance levels

Set stop losses, manage position sizes, and protect your capital

Choose and trade the right cryptocurrency pairs for your strategy

Prerequisites

Complete wallet tutorial (understanding deposits/withdrawals)

Basic understanding of cryptocurrency markets and price charts

Risk capital only - never trade with money you can't afford to lose

Step-by-Step Guide

Step 1: Access the Trading Dashboard

1

- •Click "Trade" from the main navigation menu

- •Select your preferred trading pair (e.g., BTC/USDT)

- •Choose between Spot, Margin, or Futures trading

Step 2: Understanding Market Data

2

- •Current Price: Latest trading price for the pair

- •24h Change: Percentage price movement in last 24 hours

- •24h High/Low: Price range boundaries

- •24h Volume: Total trading activity

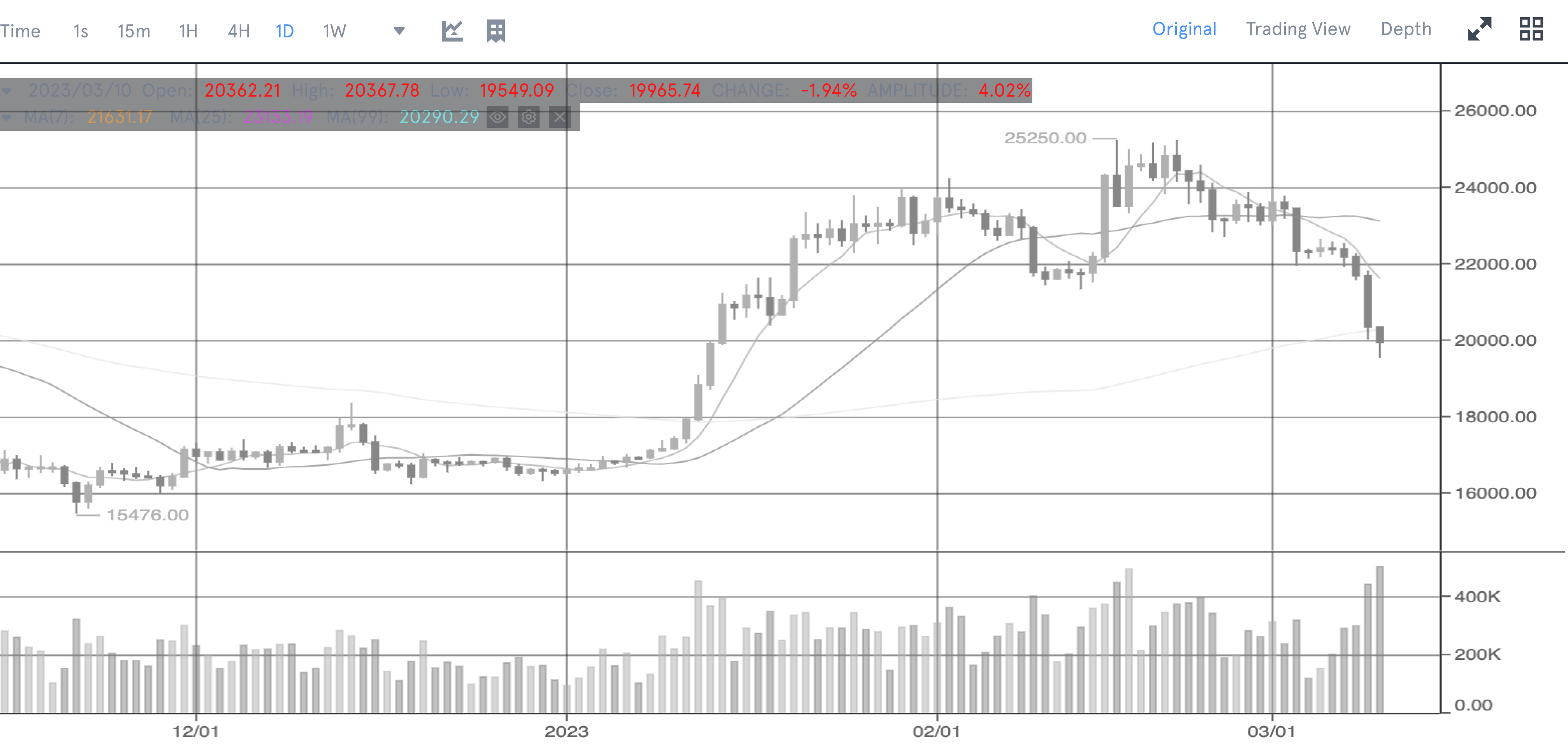

Step 3: Utilize Advanced Charting Tools

3

- •Time Frames: 1m, 5m, 15m, 1H, 4H, 1D, 1W, 1M

- •Chart Types: Candlestick, Line, Area, Depth

- •Indicators: MA, EMA, MACD, RSI, Bollinger Bands

- •Drawing Tools: Trend lines, support/resistance levels

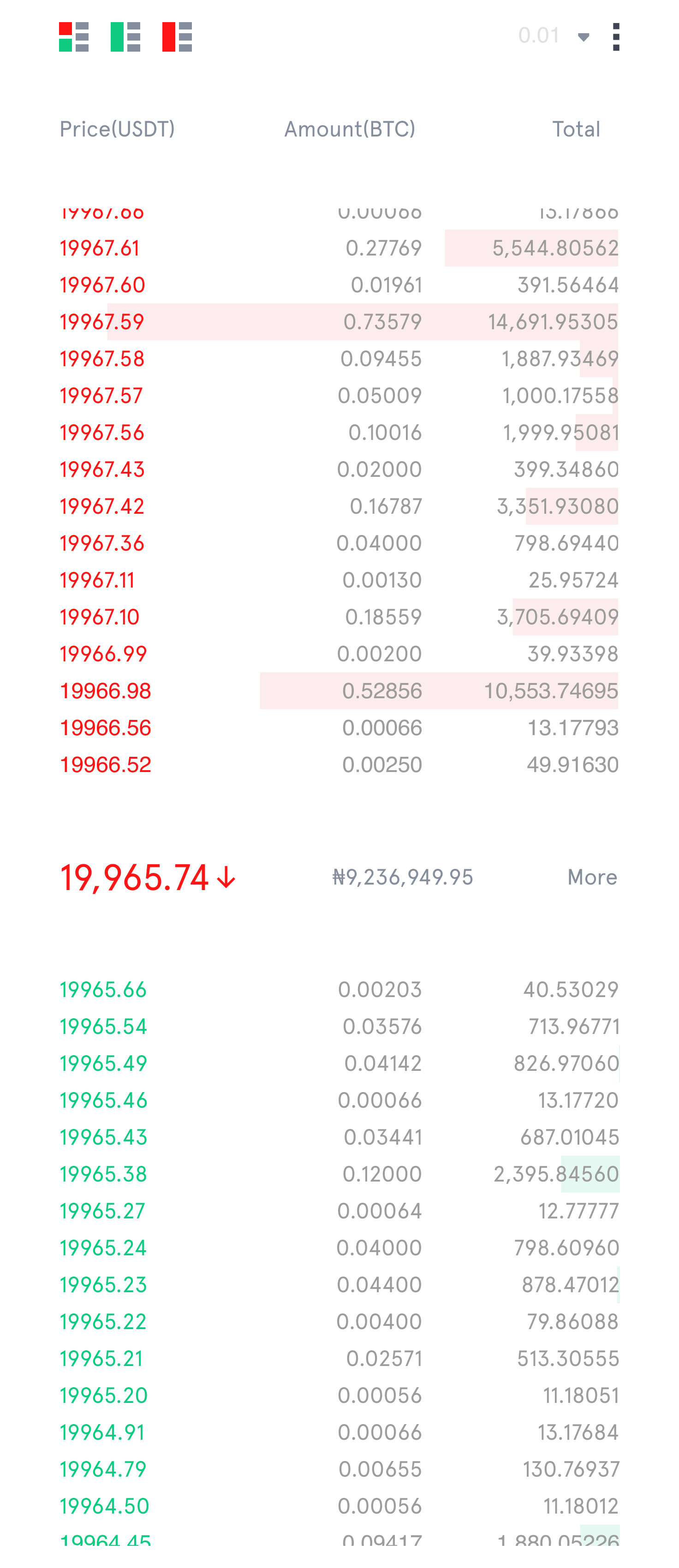

Step 4: Understanding the Order Book

4

- •Buy Orders (Bids): Displayed in green with price and quantity

- •Sell Orders (Asks): Displayed in red with price and quantity

- •Spread: Difference between highest bid and lowest ask

- •Market Depth: Visual representation of order volume

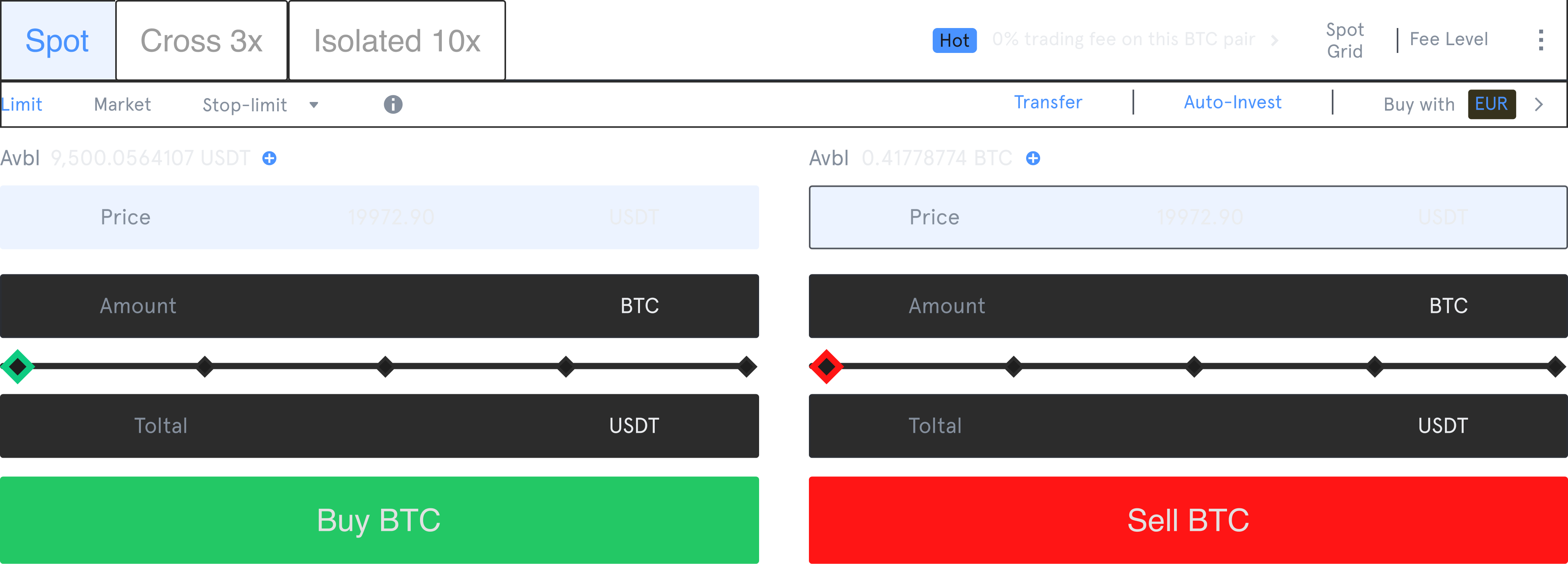

Step 5: Placing a Limit Order

5

- Select "Limit" as your order type

- Enter your desired price per unit

- Specify the amount you want to buy or sell

- Review the total cost (price × amount + fees)

- Click "Buy BTC" or "Sell BTC" to place the order

Limit orders give you price control but may not fill immediately. Use market orders for instant execution at current prices.

Step 6: Using Market Orders

6

- Select "Market" order type

- Choose Buy or Sell

- Enter the amount you want to trade

- Review the estimated execution price

- Click to execute immediately at market price

- • Better price control

- • May not fill immediately

- • Best for patient traders

- • Ideal for volatile markets

- • Instant execution

- • May have slippage

- • Best for urgent trades

- • Ideal for liquid markets

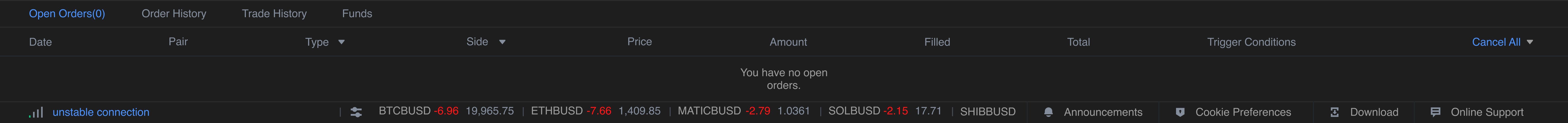

Step 7: Monitor Your Trades

7

- •Market Trades: Recent executed trades from all users

- •My Trades: Your completed trade history

- •Open Orders: Your pending limit orders

- •Order History: All past orders and their status

Step 8: Managing Open Orders

8

- •View all open orders with details (date, pair, price, amount)

- •Track filled vs unfilled portions of your orders

- •Cancel individual orders or all orders at once

- •Monitor trigger conditions for stop-limit orders

Step 9: Searching and Selecting Trading Pairs

9

- •Use search functionality to find specific pairs quickly

- •Filter by quote currency (USDT, BTC, ETH, etc.)

- •Sort by volume, price change, or market cap

- •Add favorite pairs for quick access

Advanced Trading Features

Protect profits or limit losses by setting trigger prices for automatic order execution.

- •Set stop price to trigger the order

- •Define limit price for execution

- •Ideal for risk management

Trade with leverage to amplify potential profits (and risks) using borrowed funds.

- •Choose between Cross and Isolated margin

- •Leverage up to 10x (varies by pair)

- •Manage liquidation risks carefully

Risk Management Best Practices

Essential Trading Safety Guidelines

Never invest more than you can afford to lose

Only trade with risk capital, not funds needed for living expenses

Protect your capital by limiting potential losses on each trade

Don't put all funds into a single asset or trading pair

Start small and learn gradually

Begin with smaller positions while you develop your trading skills

Stick to your strategy and avoid impulsive decisions based on fear or greed

Next Steps

Learn to manage deposits, withdrawals, and security

Explore Marketplace

Discover real estate, commodities, and startup investments

Understand trading fees and how to reduce costs

Need Help?

If you encounter any issues or have questions about trading on NYYU, our support team is here to help.