Token Swapping Made Easy

Complete guide to swapping cryptocurrencies with optimal rates, slippage protection, and cross-chain bridges

Swap Tutorial

Token Swapping Made Easy

Exchange cryptocurrencies instantly with the best rates, protect yourself from slippage, and bridge assets across multiple blockchains. Your complete guide to seamless token swapping.

NYYU Swap Overview

The NYYU Swap section enables seamless exchange of various digital assets with an automated bridge managing inter-network transfers behind the scenes. Experience instant swaps with competitive rates and minimal slippage.

What You'll Learn

Exchange tokens in seconds without order books or complicated trading

Control price impact and protect against unfavorable rate changes

Seamlessly swap assets across different blockchain networks

Access liquidity pools and aggregated rates for optimal pricing

Prerequisites

Knowledge of different blockchain networks (for cross-chain swaps)

Step-by-Step Guide

Step 1: Access the Swap Interface

1

- •Click "Swap" from the main navigation menu

- •You'll see two input fields: "From" (asset to swap) and "To" (asset to receive)

- •Current exchange rate displays between the fields

- •Your available balances show for quick reference

Speed

Instant execution without waiting for order matching

Simplicity

No need to understand order books or limit prices

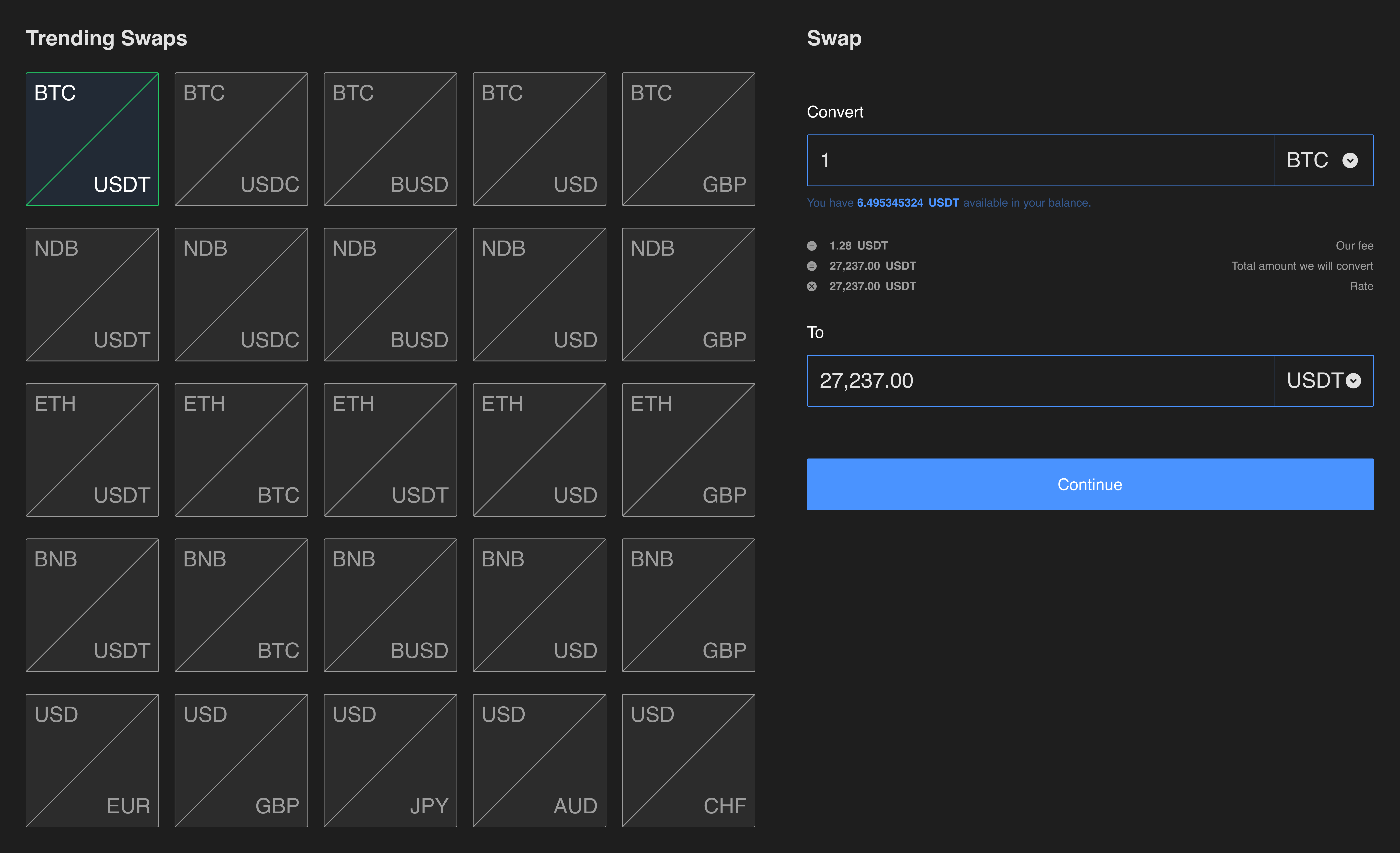

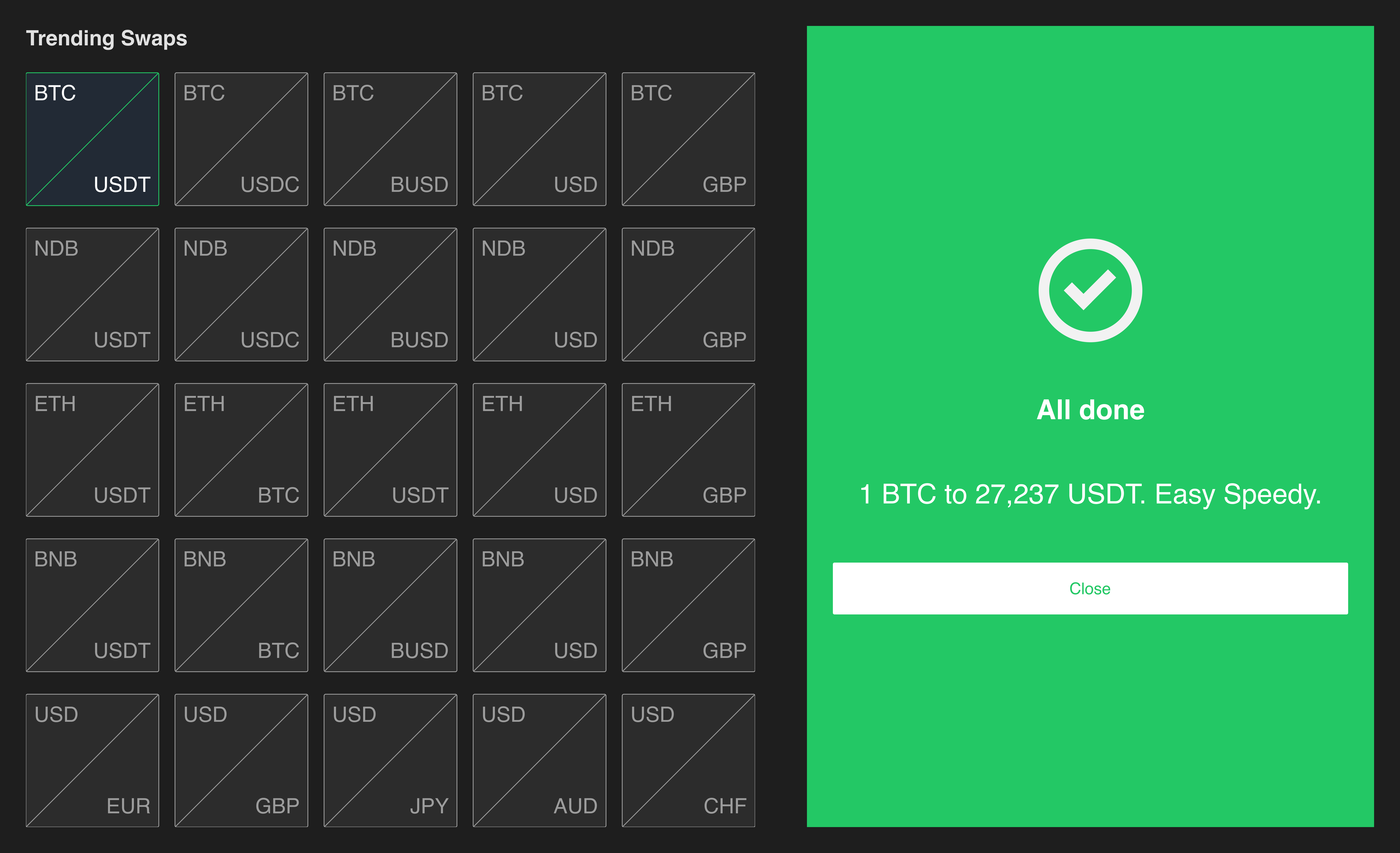

Step 2: View Available Swap Options

2

- •View trending swap pairs with popular combinations

- •Check current exchange rates for each pair

- •Use search functionality to find specific tokens

- •Filter by network or token type

Step 3: Select Your Trading Pair

3

- Click the token selector in the "From" field

- Search or scroll to find your source token

- View your available balance for that token

- Select the token you want to swap from

- Click the token selector in the "To" field

- Choose the token you want to receive

- Review the exchange rate displayed

- Verify the swap route (especially for cross-chain swaps)

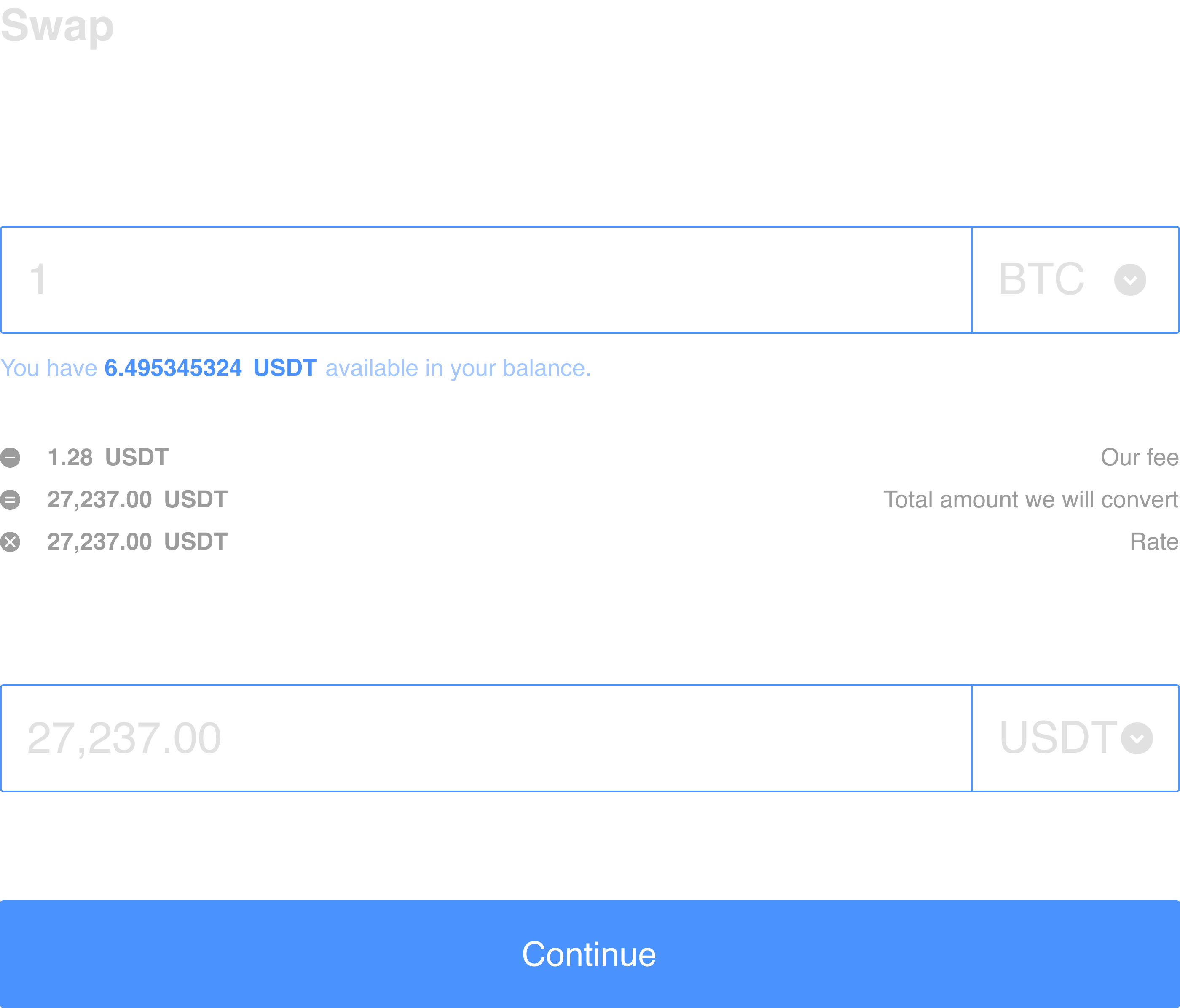

Step 4: Enter Swap Amount

4

- Type the amount you want to swap in the "From" field

- Or enter the amount you want to receive in the "To" field

- The corresponding amount auto-calculates based on current rates

- Use the "Max" button to swap your entire balance

- •Exchange Rate: Price per token for this swap

- •Price Impact: How your swap affects the market price (aim for <1%)

- •Minimum Received: Guaranteed minimum amount after slippage

- •Network Fees: Gas costs for the transaction

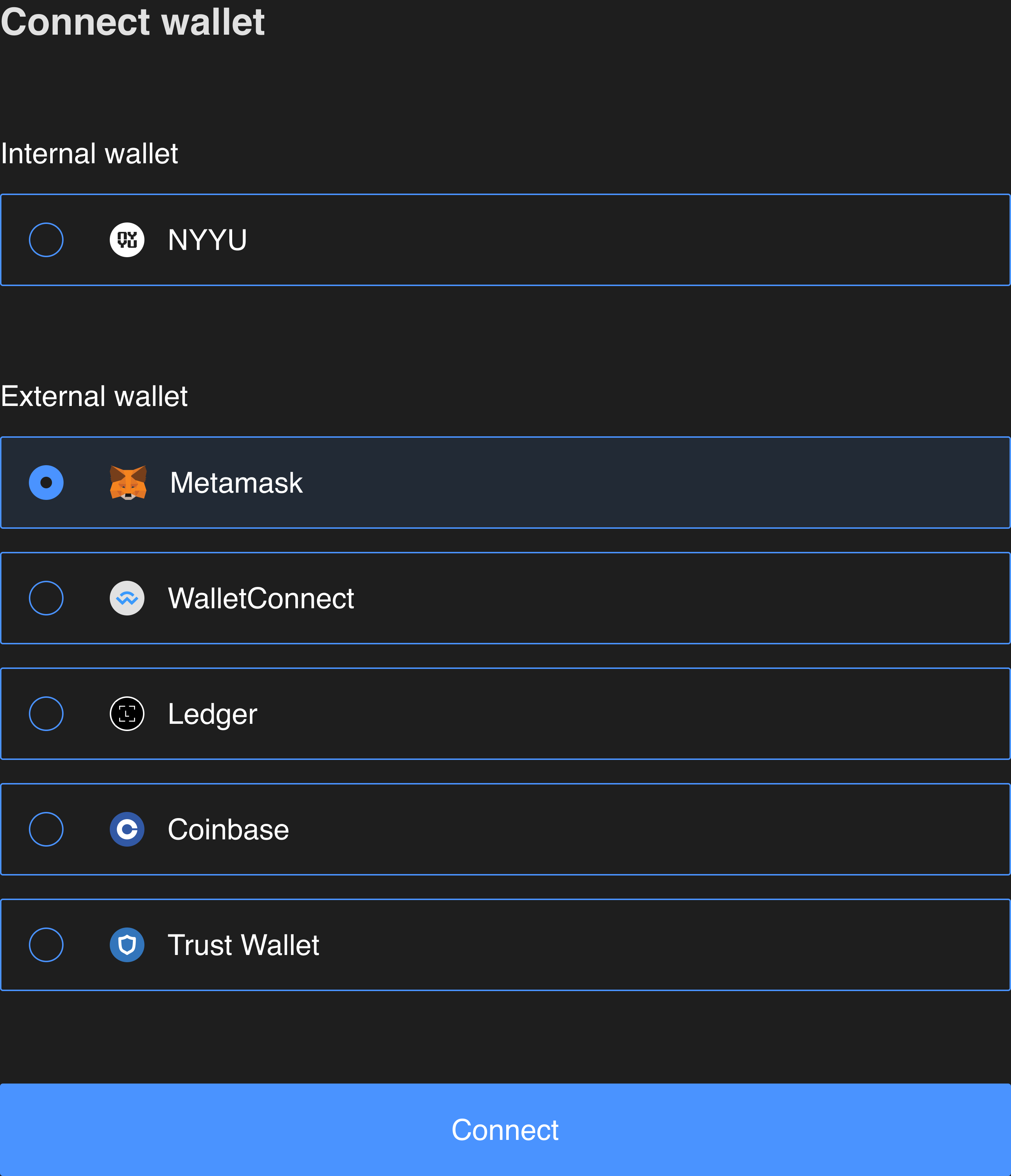

Step 5: Connect Your Wallet

5

- •Internal NYYU Wallet: Already connected, ready to swap

- •MetaMask: Browser extension or mobile app

- •WalletConnect: Connect any mobile wallet via QR code

- •Ledger/Trezor: Hardware wallet for maximum security

- •Trust Wallet, Coinbase Wallet: Other popular options

Always verify the wallet address and network before confirming. For large swaps, consider using a hardware wallet.

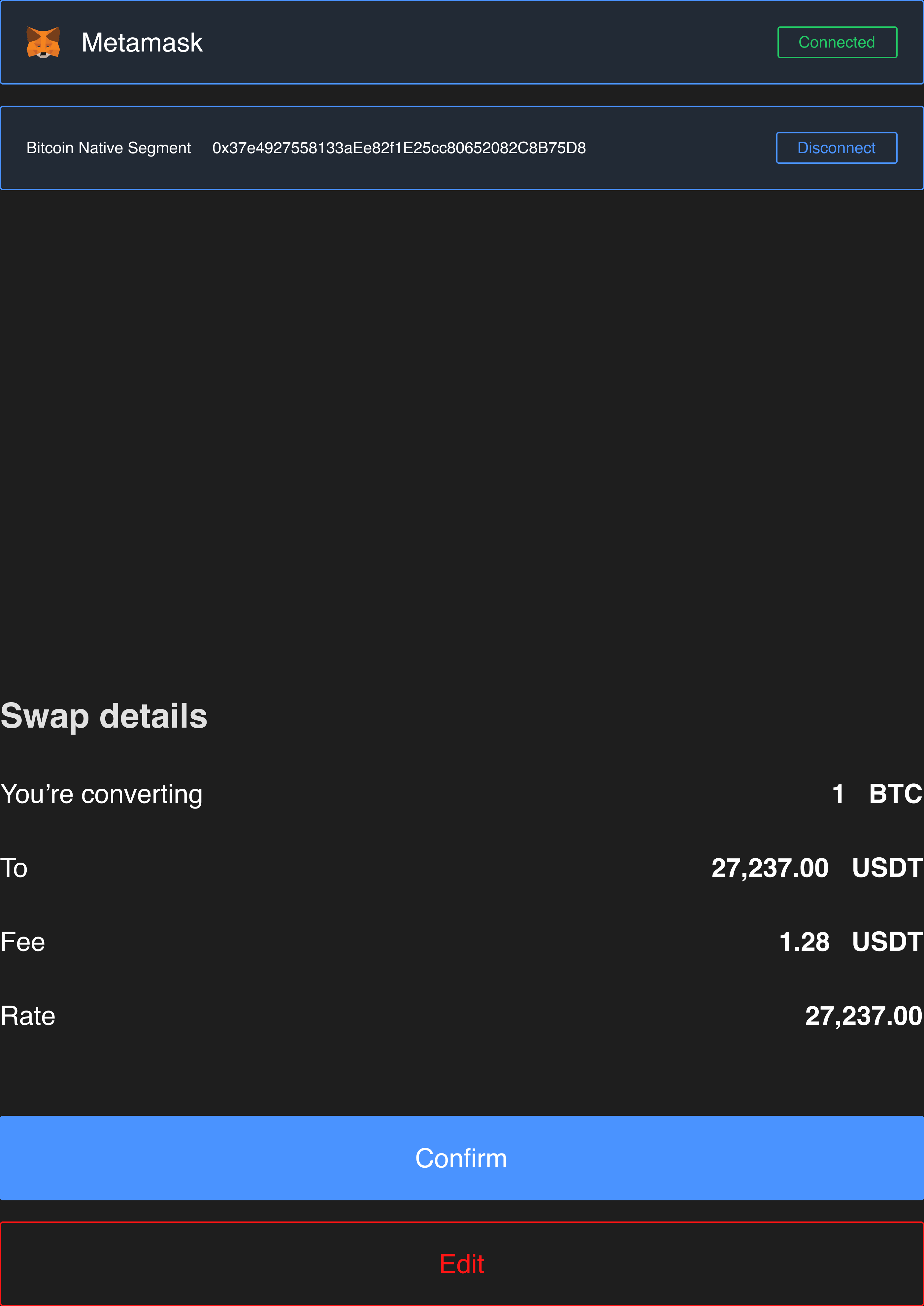

Step 6: Confirm the Swap

6

- Review all swap details one final time

- Check the conversion rate and total fees

- Verify the minimum amount you'll receive

- Adjust slippage tolerance if needed (gear icon)

- Click "Confirm Swap" to initiate the transaction

- Approve the transaction in your wallet

Stable pairs, high liquidity

Standard setting, most swaps

Volatile pairs, lower liquidity

Step 7: Complete the Swap

7

- Transaction is broadcast to the blockchain

- Wait for network confirmation (time varies by network)

- Automated bridge manages cross-chain transfers if applicable

- Monitor transaction status in real-time

- Success notification appears when complete

- New token balance reflects in your wallet immediately

- •Your source token is sent to a liquidity pool

- •Smart contract calculates optimal exchange using AMM algorithm

- •Destination token is withdrawn from pool to your wallet

- •Transaction is recorded on the blockchain for transparency

Understanding Key Swap Concepts

Pools of tokens locked in smart contracts that enable decentralized trading without order books.

- •Deeper pools = better rates

- •Less slippage on large trades

- •Always available for trading

How much your trade affects the token price due to the size of your order relative to pool liquidity.

- •Keep below 1% when possible

- •Split large orders to reduce impact

- •Higher impact = worse rates

Maximum price movement you're willing to accept between order submission and execution.

- •Too low = failed transactions

- •Too high = worse execution

- •Balance between speed and price

Automated infrastructure that enables swapping tokens across different blockchain networks.

- •Seamless multi-chain swaps

- •Takes slightly longer (5-15 min)

- •May have higher fees

Tips & Tricks

For large amounts, compare swap rates with traditional trading. Sometimes using the order book with limit orders gives better rates than swaps, especially for high-liquidity pairs like BTC/USDT.

Network fees (gas) fluctuate throughout the day. For non-urgent swaps, use gas trackers to swap during low-fee periods. Early morning UTC typically has lower fees on Ethereum.

Sometimes swapping through a popular intermediate token (like USDT or BNB) gives better overall rates than direct swaps between obscure pairs. The swap interface shows you the optimal route automatically.

Common Mistakes to Avoid

Large swaps in low-liquidity pools cause significant price impact, meaning you get worse rates. If price impact is high, consider splitting into multiple smaller swaps or using traditional trading instead.

Setting slippage too high (like 10-50%) makes you vulnerable to front-running bots and MEV extractors who will take advantage of your tolerance. Keep slippage reasonable unless absolutely necessary.

Gas fees can sometimes exceed the value of your swap for small amounts. Always check the estimated network fees before confirming. Consider batching multiple small swaps into one larger transaction.

Double-check you're on the correct blockchain network. Sending tokens to the wrong network can result in permanent loss. Always verify the network matches your wallet and destination address.

Swap vs Trade: When to Use Each

| Feature | Swap | Trade |

|---|---|---|

| Speed | ⚡ Instant execution | ⏱️ Depends on order matching |

| Complexity | ✅ Simple, user-friendly | 📊 Requires market knowledge |

| Price Control | ❌ Market price only | ✅ Set your own price |

| Large Orders | ⚠️ May have high price impact | ✅ Better for large amounts |

| Slippage Risk | ⚠️ Can be significant | ✅ Zero with limit orders |

| Best For | Quick, small-medium swaps | Large orders, better rates |

Next Steps

Learn advanced trading with limit and market orders

Wallet Management

Manage your assets and track your portfolio

Understand swap fees and network costs

Need Help?

Have questions about swapping on NYYU? Our support team is ready to assist you with any issues or concerns.