NYYU Marketplace Guide

Complete guide to investing in real estate, startups, crypto presales, and commodities through auctions and token offerings

Marketplace Tutorial

NYYU Marketplace Guide

Discover alternative investment opportunities including real estate properties, startup equity, cryptocurrency presales, and commodities. Your complete guide to diversifying beyond traditional crypto trading.

NYYU Marketplace Overview

The NYYU Marketplace provides access to diverse investment opportunities across multiple asset classes, all in one platform. From real estate to startup equity, crypto presales to commodities, discover and invest in assets that align with your financial goals.

What You'll Learn

Buy fractional shares in income-generating properties worldwide

Invest in early-stage companies and innovative projects

Access token sales before public listings at discounted prices

Trade physical assets like gold, silver, and oil

Bid on exclusive assets in timed auctions and win at competitive prices

Track all your marketplace investments in one dashboard

Prerequisites

Completed KYC verification (required for most marketplace listings)

Understanding of investment risks and long-term holding periods

Accredited investor status may be required for certain listings

Step-by-Step Guide

Step 1: Access the Marketplace

1

- •Click "Marketplace" from the main navigation menu

- •Browse by category: Real Estate, Startups, Crypto, Commodities

- •Use filters to narrow by investment size, risk level, or asset type

- •View featured opportunities on the homepage

Real Estate Investments

Step 2: Browse Real Estate Properties

2

- •Property Type: Office, residential, retail, mixed-use

- •Expected IRR: Projected internal rate of return (typically 8-15%)

- •Investment Period: Typical hold period of 3-7 years

- •Minimum Investment: Starting amounts from $500-$10,000

- •Location: Property address and neighborhood statistics

- •Occupancy Rate: Current tenant occupancy percentage

- •Development Stage: Planning, construction, renovated, or income-generating

Step 3: View Property Details

3

- •Property overview with photos and videos

- •Financial projections and historical performance

- •Interactive location map with nearby amenities

- •Neighborhood statistics and market trends

- •Investment documents: prospectus, risk disclosures

Step 4: Invest in Real Estate

4

- Enter your investment amount (respecting minimum/maximum limits)

- Review investment summary and projected returns

- Select payment method: NYYU Wallet, Credit Card, Bank Transfer, or Crypto

- Review and accept investment agreement

- Confirm purchase

- Receive investment certificate and ownership documentation

- • Instant confirmation

- • No additional fees

- • Use crypto or fiat balance

- • Immediate processing

- • 2.9% + $0.30 fee

- • Visa, Mastercard, Amex

- • 1-3 business days

- • Lower fees ($0-$5)

- • ACH or wire transfer

- • BTC, ETH, USDT supported

- • Network confirmation wait

- • Network fee applies

Real estate is illiquid - you cannot sell instantly like stocks or crypto. Investment periods typically range 3-7 years. Market conditions, vacancy rates, and property management quality significantly impact returns. IRR projections are estimates, not guarantees.

Startup Investments

Step 5: Browse Startup Projects

5

- •Company Overview: Mission, product/service, and team

- •Funding Goal: Target raise amount and current progress

- •Valuation: Pre-money and post-money company valuation

- •Investment Terms: Equity percentage, minimum investment

- •Traction Metrics: Users, revenue, growth rate

- •Media: Pitch deck, demo videos, product screenshots

Step 6: View Startup Details

Step 7: Invest in Startups

7

- Review all startup documentation (pitch deck, financials, terms)

- Enter investment amount and calculate equity stake

- Complete accredited investor verification if required

- Select payment method

- Sign investment agreement electronically

- Confirm investment and receive equity certificates

Startups are high-risk investments. Most startups fail, and you could lose your entire investment. Equity is highly illiquid with no guarantee of exit. Only invest what you can afford to lose entirely. Projected returns are speculative.

Crypto Presales

Step 8: Browse Crypto Presales

8

- •Token Details: Name, symbol, blockchain network

- •Sale Price: Price per token in current round

- •Listing Price: Expected price at public launch

- •Bonus Structure: Early bird bonuses and tier discounts

- •Vesting Schedule: Token unlock timeline

- •Use Case: Project utility and tokenomics

Step 9: View Presale Details

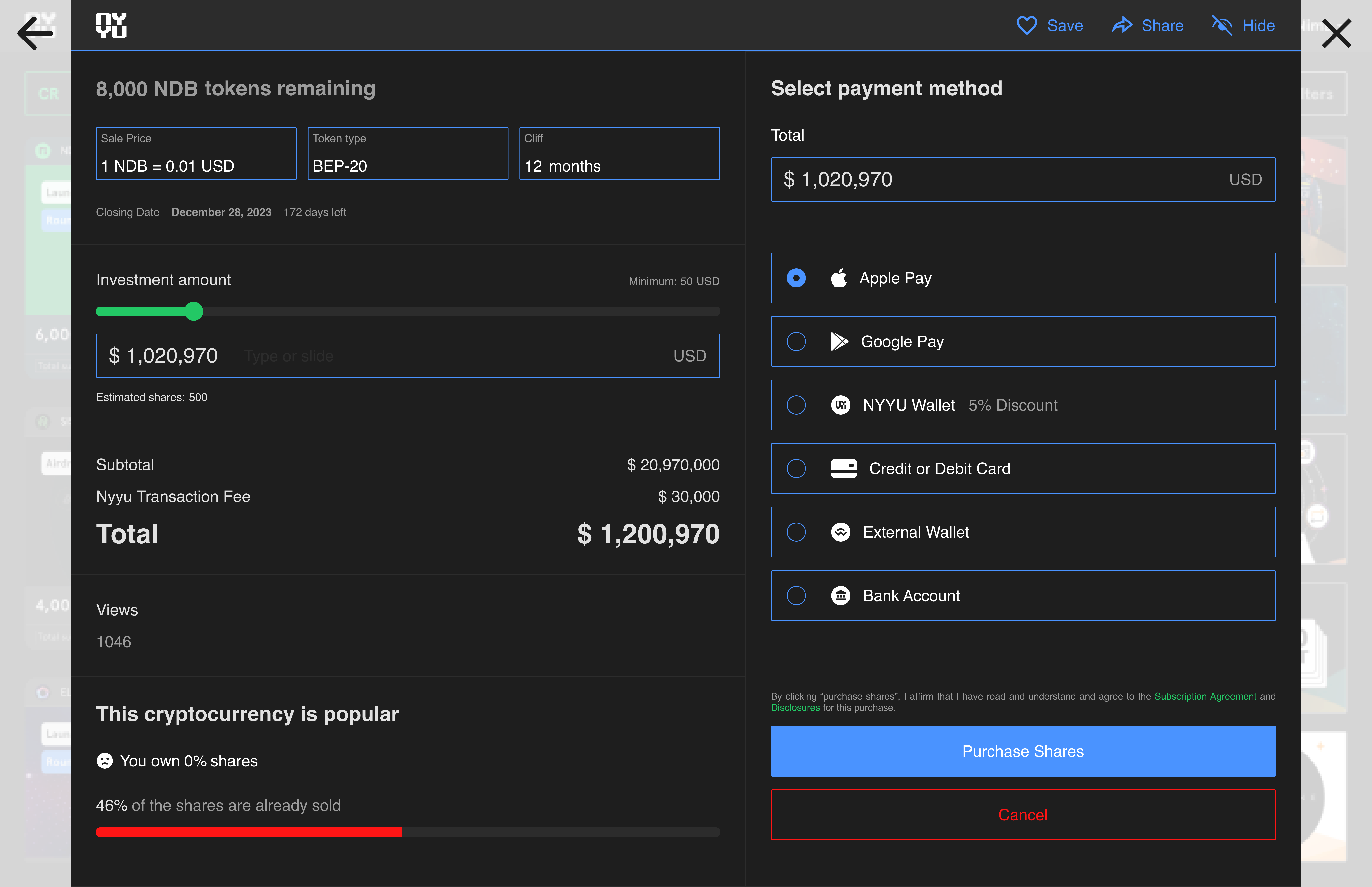

Step 10: Participate in Presale

10

- Read whitepaper and verify smart contract audit

- Check token distribution and team vesting

- Calculate potential ROI based on listing price projections

- Choose presale round and enter investment amount

- Complete KYC if required

- Pay using supported cryptocurrencies or fiat

- Receive tokens according to vesting schedule

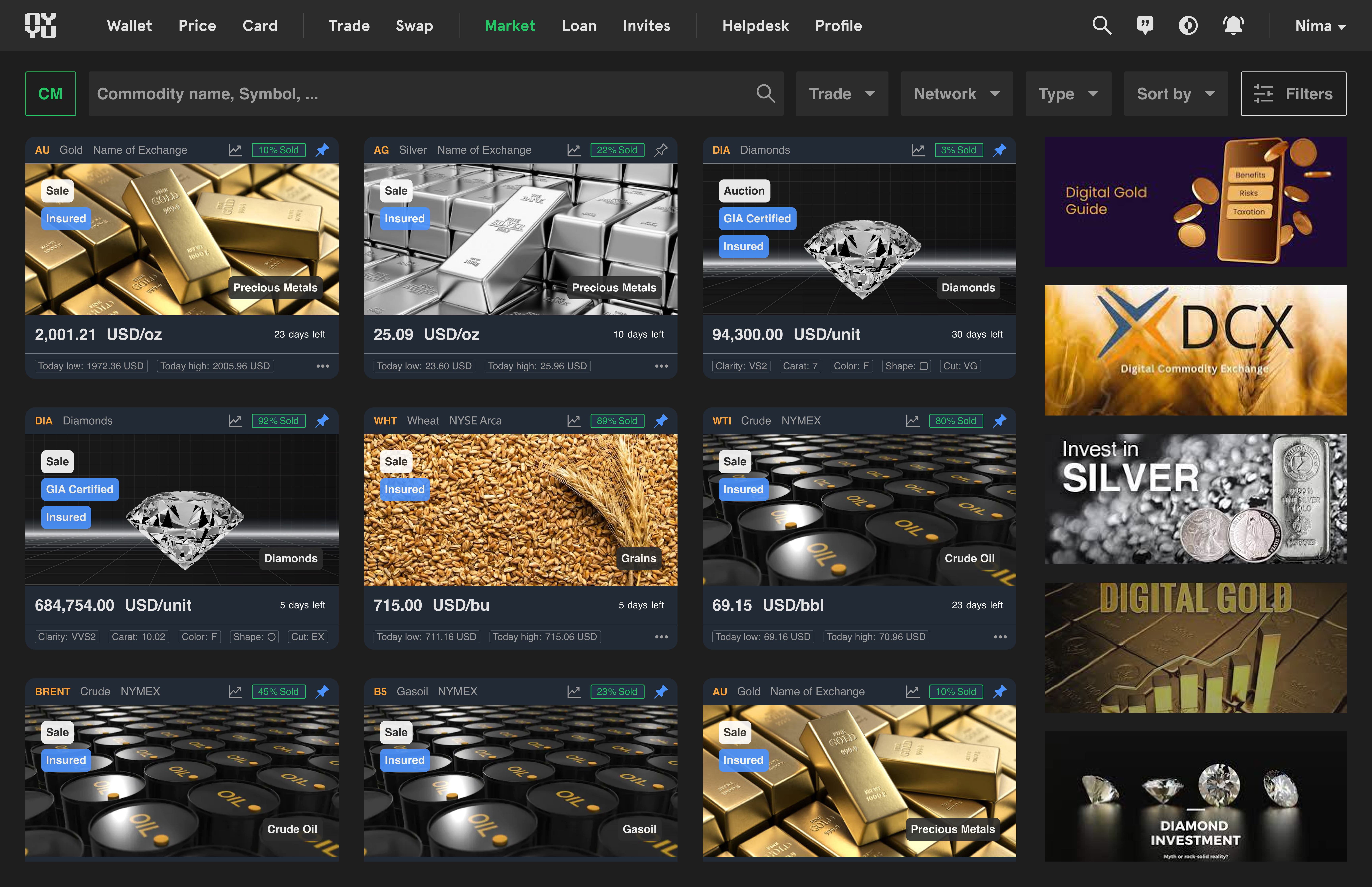

Commodity Trading

Step 11: Browse Commodities

11

- •Precious Metals: Gold, silver, platinum, palladium

- •Energy: Crude oil, natural gas, renewable energy certificates

- •Agricultural: Wheat, corn, soybeans, coffee

- •Industrial Metals: Copper, aluminum, steel

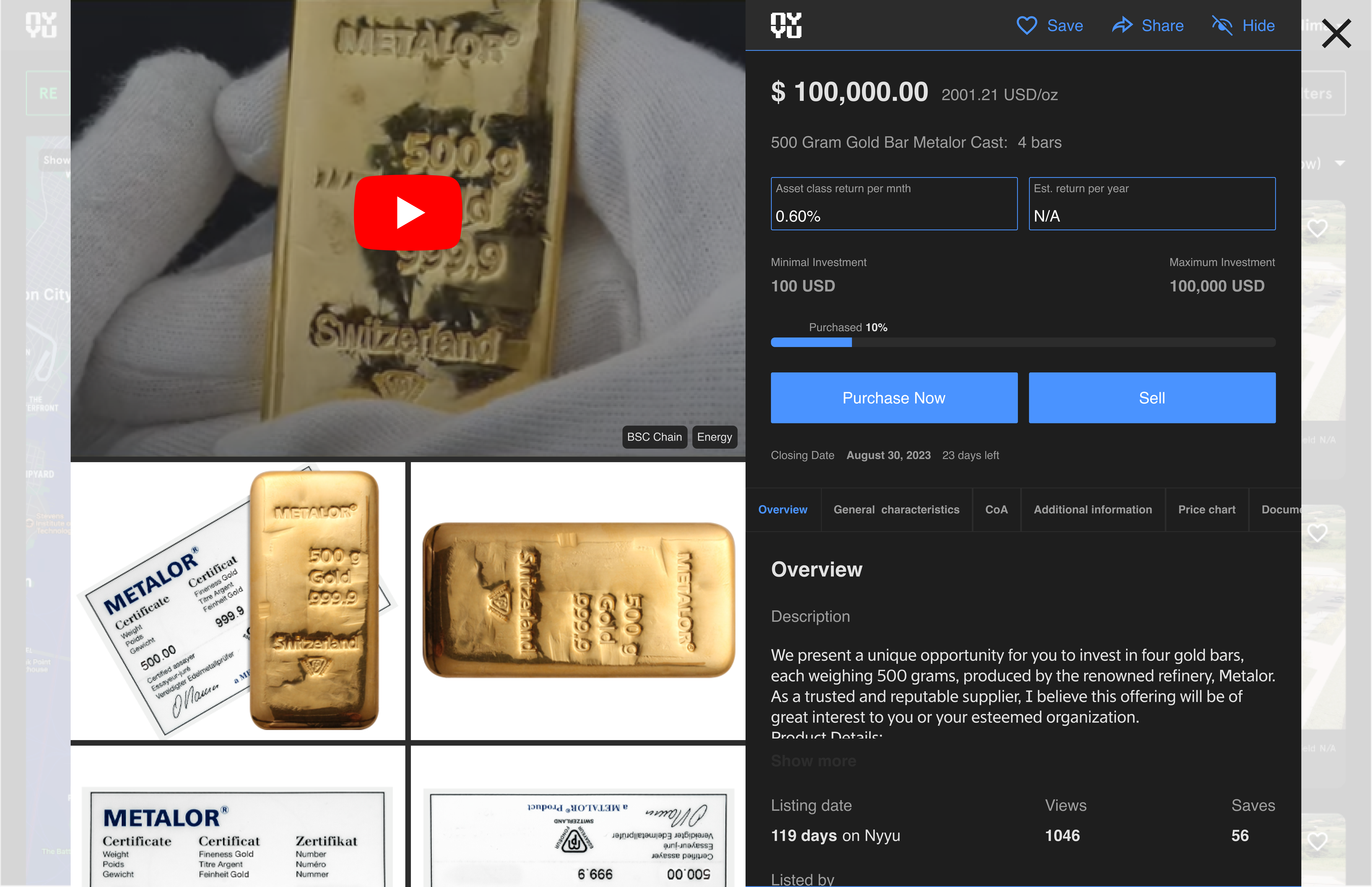

Step 12: Invest in Commodities

12

- Select commodity type and quantity

- Review current market price and trends

- Choose storage option (vault or physical delivery)

- Enter investment amount

- Select payment method

- Receive tokenized commodity certificates

- Trade or hold until you want to sell or take delivery

Managing Your Investments

Step 13: Track Your Portfolio

13

- •Total portfolio value across all marketplace categories

- •Asset allocation breakdown (real estate, startups, crypto, commodities)

- •Performance metrics: ROI, IRR, total gains/losses

- •Income tracking: dividends, rental income, token rewards

- •Investment documents: certificates, receipts, tax forms

- •Updates and news: Property renovations, startup milestones, presale schedules

Some marketplace investments can be traded on NYYU's secondary market before maturity:

- • Real estate shares after 6-month minimum hold

- • Startup equity tokens (subject to lock-up periods)

- • Presale tokens after vesting unlock

- • Commodity tokens anytime (instant liquidity)

Investment Comparison

| Category | Min Investment | Risk Level | Liquidity | Time Horizon |

|---|---|---|---|---|

| Real Estate | $500-$10,000 | Medium | Low (6mo-7yr) | 3-7 years |

| Startups | $100-$5,000 | Very High | Very Low (3-10yr) | 5-10 years |

| Crypto Presales | $50-$1,000 | High | Medium (vesting) | 6mo-2 years |

| Commodities | $100-$500 | Low-Medium | High (instant) | Flexible |

Next Steps

Learn to manage deposits and withdrawals for investments

Trading Guide

Trade tokens and assets on secondary markets

Understand marketplace fees and transaction costs

Need Help?

Questions about marketplace investments? Our team is here to help you navigate opportunities and make informed decisions.